Resource Library

Opening Doors for Business Owners

Two Ways to Fix Tax Return Mistakes Before the IRS Discovers Them

Tax law is constantly changing, making it easy to make an error on your taxes that causes you to under or overpay your taxes. Underpaying will leave you open to IRS penalties, and overpaying will mean less money in your pocket for no good reason. Fortunately, there are good news: you can undo your mistake!

Big Mistake: Filing Your Tax Return Late

While filing for your taxes, you know you have to manage the task carefully as mistakes can arise problems with the IRS later. However, there is one big mistake that people should absolutely avoid, and that’s filing their tax returns late. While it may not seem like a big deal, it brings significant consequences. This blog will go over why filing your tax return late is a big mistake.

3 Killer Tax Reduction Strategies

When it comes to taxes, we all want to reduce them as much as possible. However, no one wants to risk any problems with the IRS in the future. Fortunately, we’ve put together 3 killer tax reduction strategies that are safe to implement and will save you some bucks here and there. Keep on reading to find out what these strategies are!

Can Home-Office Tax Deductions Include Garage Space?

Are you claiming a tax deduction for your home office? Should you include your garage space when calculating your business-use percentage? This blog will discuss what elements are needed for you to be able to include the garage as a home office space.

Cryptocurrency and the IRS

With the increased use of technology, cryptocurrencies have now become mainstream. Cryptocurrencies have federal income tax implications that you may not know of. This blog will go over everything you need to know about cryptocurrencies and the IRS!

How to Deduct 100% of Your Employee Recreational Activities and Parties

Are you planning to host an employee party or recreational event? If you, you’ll want to ensure that you qualify for 100% employee entertainment tax deductions. If you don’t do things correctly, you may end up producing no deductions at all. This blog will go over how to deduct 100% of your employee recreational activities and parties so that you can benefit from the tax codes in place.

Big Government Help for the Self-Employed

With COVID-19 still at large, self-employed businesses still have it rough. Fortunately, legislators haven’t forgotten about them. In fact, Congress has taken unprecedented steps towards helping the self-employed who are facing financial problems. This blog will go over the big government help for the self-employed that is taking place to help you see if you’re eligible for these benefits.

Married? Filing Separately May Be a Great Money-Saving Strategy for the Tax Year of 2020

It is not surprising to see married couples filing joint federal income tax returns as it results in a smaller tax bill than if the couple were to file two separate tax returns. However, things have just changed! For 2020, Congress put up some temporary but very significant tax-benefit provisions! These provisions may help put more money in your pocket.

Tax Opportunities: Expanded Individual Tax Credits in New Law

Congress is giving away billions of dollars in additional tax credits on your 1040 individual tax form return for the tax year of 2021. These expanded credits that will be in place temporarily include the child tax credit and the dependent care credit.

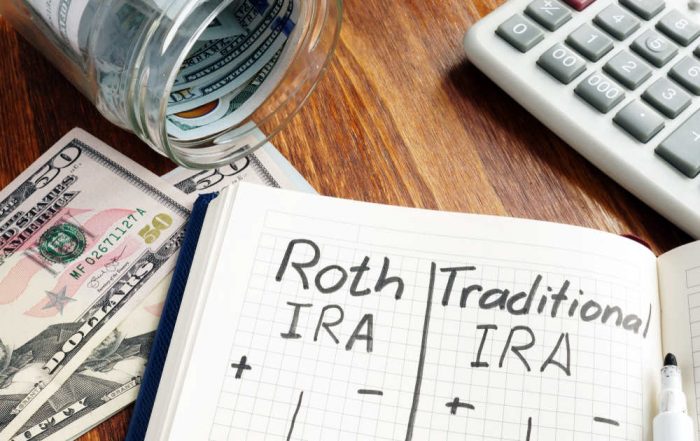

Roth IRA vs Traditional IRA: Which is Better?

When it comes to individual retirement accounts, Roth IRA tends to get more hype. Why? Because you pay the taxes upfront and your eventual withdrawals (assuming you meet the required age) are completely tax-free. While we all love the words “tax-free,” there are times where traditional IRA will put more money in your pocket. This blog will go over Roth IRA vs traditional IRA to see which one is better.

Is a Rental Property Considered A Business? What You Need to Know

Are you a landlord that rents out a single-family home, an apartment complex, or even a business space? If so, then you must have wondered if your rental property is considered a business when it comes to taxes. There are two main classifications when it comes to rental properties and taxes. This blog will go over what criteria make a rental property considered a business.

How to Handle Key Non-Tax Financial Issues When a Loved One Passes Away

When a financially stable loved one passes away, and you’re named the executor of the deceased person’s estate, you’ll have to take the challenging job of acting as the executor for the loved one’s estate. Good for you! However, this role can be a lot of work. This blog will go over how to handle key non-tax financial issues when a loved one passes away.

Slash Taxes with a Reasonable Salary for S Corporation Owner

Most corporation owners form S corporations to save money on taxes. However, to make the most out of S Corporations, paying yourself a reasonably low salary is an intelligent tactic to follow. This blog will go over how you can slash taxes with a reasonably low salary for an S corporation owner.

Are COVID-19-Related Government Grants Taxable?

During these times with the pandemic, the federal government is providing billions of dollars in grants to individuals and businesses. This article will discuss different types of COVID-19-related grants and whether or not they’re taxable.

New IRS Efforts to Destroy Tax Deductions for PPP Paid Expenses

From what we know, when lawmakers originally passed the Paycheck Protection Program (PPP), it was supposedly under the provisions that people don’t pay taxes on the forgiveness amount and that they could deduct the expenses that they paid with the PPP money.

How to Get Approved for Credit in a Financial Downturn

During a recession, it is common for many people to rely on credit cards and loans to make it through with their finances. However, these financial products can be more difficult to qualify for during these times. This blog will go over a few tips on how to get approved for credit in a financial downturn.

Last-Minute Year-End General Business Income Tax Deductions for 2020

Tax-related topics are always complicated, so what can you do to deduct your taxes? This blog will go over last-minute year-end general business income tax deductions that you should implement before the end of 2020.

Trade-In Reimbursement by Corporations

Have you recently traded-in a company vehicle and want to understand the trade-in reimbursement by corporations? We understand the topic can be confusing, so this article will help explain the process and your options.

Don’t Let Section 179 Recapture Hurt You

If you took the Section 179 expensing deduction on your vehicle, you might have some questions. How do you keep it? What is a Section 179 recapture? In this blog, we'll explain what the recaptures are and how to avoid them.

Which Important IRS Audit Document is Commonly Ignored?

If you received a letter telling you that you're subject to an IRS audit, what's that one important IRS audit document that can turn into a headache? It's the one record most business owners hate keeping.