When it comes to individual retirement accounts, Roth IRA tends to get more hype. Why? Because you pay the taxes upfront and your eventual withdrawals (assuming you meet the required age) are completely tax-free. While we all love the words “tax-free,” there are times where traditional IRA will put more money in your pocket. This blog will go over Roth IRA vs traditional IRA to see which one is better.

Contribution Limit

In 2019, the contribution limit for both traditional and Roth IRA is less than $6,000 ($7,000 for those ages 50 or more) or your taxable compensation for the year. One has to make the decision on what’s best. For example, let’s say that your tax rate is 32% and you invest $5k a year in an IRA and earn 6% interest. Should you put the $5k a year into a traditional or a Roth IRA?

Let’s say that neither you nor your spouse is covered by a workplace retirement plan, meaning that you can contribute the $5k a year without any worries as it’s under the contribution limits. What’s the best path?

Traditional IRA

If you invest the $5k into a traditional IRA, you’ll be able to create a side fund of $1,600 ($5k x 32%). You pay 32% taxes each year on the side fund, making your side fund grow 4.08% (68% of 6%).

Roth IRA

Roth contributions, on the other hand, are not deductible, meaning no side fund. So your annual investment will remain at $5k.

Cashing Out

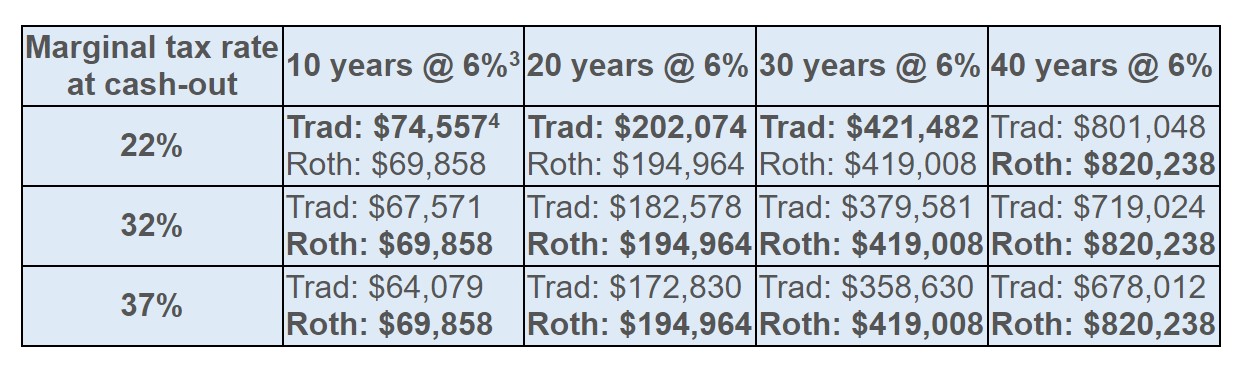

When it comes to Roth, your marginal tax rate at the time of the payout won’t matter as you paid your taxes before the money went into the account. The entire amount now belongs to you, with no additional taxes due. However, with a traditional IRA, your current tax bracket really matters! You may have taken care of the taxes on the side fund annually along the way, but traditional IRA (both contributions and growth) are taxed at your current marginal tax at the time you cash out. The table below illustrates how this looks, with tax rates of 22%, 32%, and 37% at the time you cash out. [The winners are indicated in bold]:

Above you can see how traditional IRA needs a low tax rate at the time of cash-out to win. However, even at the 22% cash-out, Roth wins at the 40% mark.

Rate of Growth

How about the rate of growth? Do variances change anything here? Let’s check it out.

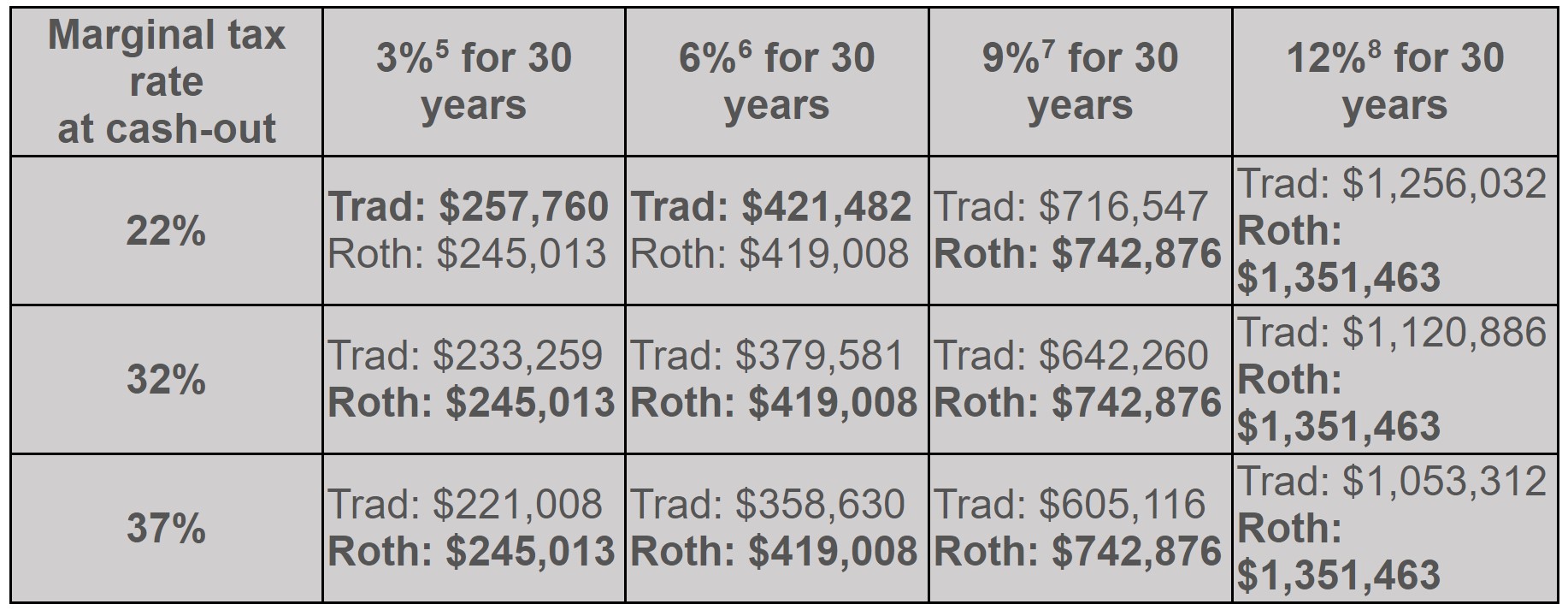

Below, you can see different rates of growth for a fixed period (30 years) before you withdraw money. We’ll consider three different marginal tax rates at the time of cashout for 22%, 32%, and 37%:

As seen above, the traditional IRA/side fund combo only wins when your marginal tax rate is lower at the time of withdrawal, and at lower rates of growth. Roth still wins even at higher rates like 9% and 12%, even when you’re at a higher tax bracket when you withdraw the money.

Tax Factor

So what’s going on there? First off, the side fund is not tax-favorable in any way! Taxes also hobble your cash-out on traditional IRA:

- You pay taxes as you earn money on a side fund

- You pay taxes on accumulated growth with traditional IRQ the moment you withdraw the money

Look into the Future

How will tax brackets look like years from now? Sadly, there’s no way to know for sure. No one can predict what the government will be doing tax-wise down the road. However, we do think it’s prominent that federal income taxes will not be abolished! A better approach is to look at your individual tax situation. Nothing is ever certain, but events like retirement, children leaving home, and your mortgage getting paid off are somewhat foreseeable events that will affect your time of investment and tax bracket one way or another. The time length you plan to keep the investment really matters, As seen above; with enough time, Roth eventually catches up and passes the traditional IRA, even when your tax bracket is low at the moment you cash out.

Additional Roth IRA Advantages

Aside from the Roth benefits previously mentioned, Roth also offers a few other additional perks, such as:

- No required minimum distribution (RMD)

- Longer period to contribute

- More flexibility with withdrawals – you can withdraw your contributions to a Roth at any moment without any penalty

Traditional IRA Advantages

Is there ever a time where a traditional IRA is better? There could be under these circumstances:

- Lowers your taxable income at the time of contribution – Due to contributions to traditional IRAs being generally deductible, they can reduce your taxable income at the moment you make them. If you’re in a high tax bracket at the moment or looking for a last-minute deduction, this may be something worth considering. But remember, you have to invest that money in the side fund to have even a chance at coming out ahead with traditional IRA.

- State income tax considerations – If you reside in a state that charges high income taxes and see yourself moving to a state with lower taxes in the future, a traditional IRA could allow you to defer those taxes and maybe even avoid them entirely in case of a move.

Takeaways

Roth IRAs offer a great load of tax advantages for your future self, while traditional IRAs give you tax breaks at the moment. The trade-off is an uncertain tax liability many years from now, maybe after you’ve stopped working. Given enough time and/or a high rate of return, you’re better off with Roth. If the current deduction is important to you, then a traditional IRA may make more sense. It’s also a good choice if you’re planning to move from a high-tax state to a low-tax state in the future. Just remember—you have to invest the side fund money to create a fighting chance for your traditional IRA to tie, if not beat, a Roth. We hope this blog helped you see the major differences between Roth IRA vs traditional IRA. At MFI Works, we know these topics can be complicated, so don’t hesitate to contact us if you have any questions. To schedule a free initial business strategy session, click here.